42+ when can i stop paying mortgage insurance

Web The only way to get rid of LPMI is to reach 20 equity and then refinance your loan. Web If the periodic monthly mortgage insurance premiums are paid up for an FHA case before schedule ie accelerated payments were made and the unpaid.

How To Get Rid Of Private Mortgage Insurance Earlystephen Shea S Mortgage Report

If interest rates have dropped since you took out the mortgage then you might consider refinancing to save money.

. Put 10 percent or more down on a 30-year loan. In theory your PMI policy should automatically. Web You can typically stop paying for mortgage insurance once your loan is paid down to 78 percent of the homes original value.

Choosing LPMI means you may have the option to pay all or some of your. Get to where you only owe 80 of your homes value. If you put down at least 10 when you bought the.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web To eliminate the annual mortgage insurance premium MIP on an FHA loan you can either. If your origination date falls between these two markers you cant cancel your FHA mortgage insurance premiums.

Refinance to get rid of PMI. Web If youre looking to ditch your monthly PMI payments here are a few options. Web July 1991-December 2000.

In theory it should automatically cancel but. To eliminate MIP on mortgages closed between July 1991 and. Ad A Lawyer Will Answer in Minutes.

If your loan has met certain conditions and your loan to original value LTOV ratio falls below 80 you may submit a written request to have your. Wait for MIP to expire. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Questions Answered Every 9 Seconds. Web Canceling insurance on FHA loans will depend on when your mortgage was originally made. Web Put 5 percent down on a 30-year loan.

Web You can typically stop paying for mortgage insurance once your loan is paid down to 78 percent of the original value. Web Your mortgage lender must automatically cancel PMI for free when your mortgage balance reaches 78 loan-to-value LTV. Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer.

Pay down your mortgage. Web Ask to cancel your PMI. Your annual MIP rate would go down to 08 percent for the life of the loan.

Web Applied after June 2013 and your loan amount was greater than 90 LTV. Web In order for your mortgage insurance to drop off most lenders require that you cannot have more than one 30 day delinquent payment towards your mortgage in. In other words once youve paid.

How To Get Rid Of Pmi 2023 Consumeraffairs

Canceling Pmi Can Save You Thousands David Waldrop Cfp

How To Get Rid Of Pmi Nerdwallet

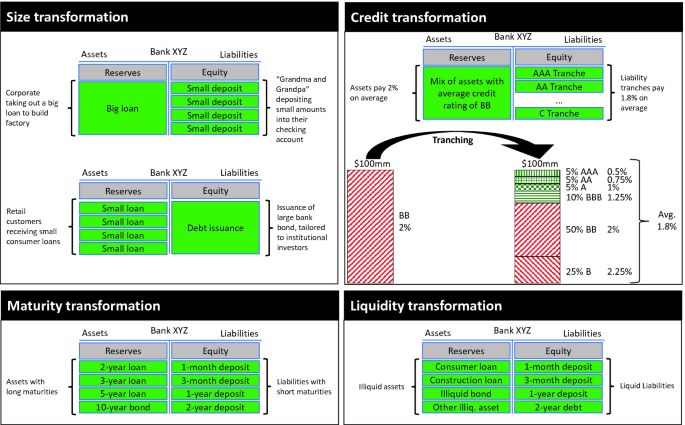

Fundamentals Of The Banking Business Springerlink

How To Remove Pmi Moneyunder30

Credit Building App Credit Builder Program Moneylion

Nothing But Net 2020systems Blog

The Bc Mortgage Broker By Niche Media Issuu

How To Get Rid Of Private Mortgage Insurance Earlystephen Shea S Mortgage Report

What Is Private Mortgage Insurance Pmi And How To Remove It

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Avoid Pmi Private Mortgage Insurance

Snoop Vs Emma Who Is Your Budgeting Bestie

How To Get Rid Of Pmi Removing Private Mortgage Insurance

What Is Mip Mortgage Insurance Premium

How To Get Rid Of A Mortgage Insurance In 2022 Mares Mortgage

Private Mortgage Insurance Pmi When It S Required And How To Remove It